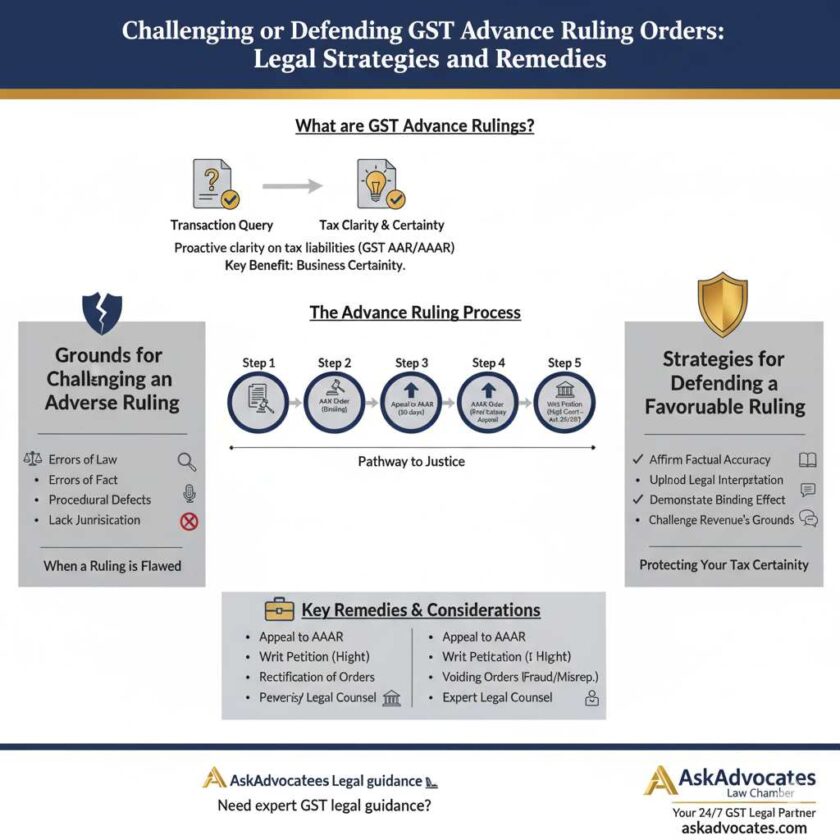

Goods and Services Tax (GST) introduced the Advance Ruling mechanism to ensure tax certainty for businesses. This process allows taxpayers to proactively seek clarity on their tax liabilities before undertaking a transaction. Consequently, a favourable ruling offers significant operational predictability. However, an adverse or flawed ruling can severely disrupt business operations and financial planning. Therefore, understanding the legal avenues to challenge or defend such rulings is absolutely paramount. AskAdvocates Law Chamber: Legal Consultancy & Litigation Services 24×7 provides comprehensive support in these complex matters. We constantly develop robust legal strategies to protect our clients’ interests in GST litigation. Furthermore, the statutory framework itself must be navigated with extreme precision and expert knowledge. We ensure compliance while aggressively pursuing justice for our clients.

The Authority for Advance Ruling (AAR) and the Appellate Authority for Advance Ruling (AAAR) issue decisions that bind the applicant and the jurisdictional officer. Nevertheless, these rulings are not immune to judicial scrutiny under higher courts. Thus, when an Advance Ruling Order contains errors of law or fact, the affected party has clear legal recourse. We specialize in identifying substantive and procedural flaws in these orders, preparing the foundation for a successful challenge. Ultimately, a strategic approach minimizes potential financial exposure and avoids protracted dispute resolution. Moreover, seeking expert guidance early is essential for preserving all available remedies. Therefore, taxpayers should immediately consult experienced GST advocates upon receiving an unfavourable ruling.

The Critical Nature of GST Advance Rulings for Business Certainty

Grounds for Challenging an Adverse Advance Ruling Order

A taxpayer must establish clear grounds for challenging an adverse Advance Ruling Order (ARO) or the subsequent Appellate Authority for Advance Ruling (AAAR) decision. Consequently, the challenge typically revolves around fundamental errors in law, facts, or procedure. Procedural defects often violate the principles of natural justice, which provides a strong basis for judicial review. For example, failing to grant an adequate opportunity to be heard constitutes a significant procedural lapse. Furthermore, an AAR or AAAR exceeding its statutory jurisdictional limits makes the ruling voidable. Therefore, a successful challenge requires meticulous documentation and deep understanding of GST law interpretation.

Substantive and Jurisdictional Challenges

- Fundamental Errors of Law:

- The Authority misinterpreted a specific provision of the Central Goods and Services Tax Act, 2017 (CGST Act). Consequently, this error leads to an incorrect determination of liability to pay tax.

- The ruling contradicts established legal precedents set by High Courts or the Supreme Court. Furthermore, such precedents are generally binding on all lower authorities.

- The AAR or AAAR misapplied a GST notification concerning the rate of tax or an exemption. Therefore, the challenge focuses on the incorrect applicability of a notification.

- A ruling concerning the classification of any goods or services relied on outdated or irrelevant HSN/SAC codes. Hence, the proper classification must be meticulously demonstrated.

- Exceeding Statutory Jurisdiction:

- The AAR ruled on a question outside the scope defined in Section 97(2) of the CGST Act. However, the scope is strictly limited to matters like admissibility of input tax credit or time and value of supply.

- The matter was already pending or decided in another proceeding concerning the same applicant. Accordingly, Section 98(2) bars the AAR from admitting such an application.

- The AAAR failed to issue a ruling because its two members held differing opinions. Nevertheless, the law deems this situation as no ruling being issued at all. This situation often necessitates subsequent action.

These detailed points demonstrate that an effective GST legal consultant will scrutinize the order for both visible and latent legal flaws. AskAdvocates Law Chamber utilizes decades of expertise to build compelling cases. We ensure that our clients’ rights are fully protected at every level of GST dispute resolution.

The Appellate Mechanism and Higher Judicial Intervention

The GST statutory framework provides a defined but limited path for appealing advance rulings. Aggrieved parties must first exhaust the departmental appeal channels before approaching the higher judiciary. However, the absence of a direct appeal beyond the AAAR necessitates invoking the High Court’s extraordinary writ jurisdiction. This requires proving the administrative order suffered from specific, severe legal infirmities. Furthermore, the strategies employed for defense significantly differ from those used for challenge. Therefore, we tailor our approach based on whether we are attacking or upholding the ruling.

Statutory Appeals to the Appellate Authority (AAAR)

Any applicant or the concerned jurisdictional officer can file an appeal against the AAR order. Consequently, this appeal must be filed with the AAAR within thirty days of the original ruling’s communication. Furthermore, the AAAR is mandated to pass its order within ninety days from the appeal filing date. We ensure strict adherence to all statutory timelines and procedural requirements, like using the prescribed Form GST ARA-02.

Key Appeal Strategy Components:

- Detailed Legal Submissions: We prepare comprehensive written submissions identifying the AAR’s specific errors of fact or law. Moreover, these submissions are crucial for framing the appeal effectively.

- Presenting Additional Facts: New facts or evidence may be presented if they are crucial to overturning the original ruling. Naturally, this helps to paint a clearer, more accurate picture of the transaction.

- Effective Personal Hearing Representation: Our GST litigation lawyers provide compelling oral arguments before the AAAR members. Importantly, this phase allows for direct interaction and clarification of technical issues.

- Cross-Referencing Jurisprudence: We strategically cite relevant High Court and Supreme Court judgments to support our client’s tax position. Therefore, legal consistency and judicial discipline are strongly invoked.

Extraordinary Legal Remedies – Writ Petitions

When the AAAR confirms an adverse ruling, the only subsequent judicial remedy lies through a Writ Petition under Article 226/227 of the Constitution of India. Notably, the High Court exercises its power of judicial review in such cases. The court does not re-examine the facts but primarily assesses the legality of the AAAR’s process and decision. Thus, this step represents the final and most powerful legal recourse available to the taxpayer.

Grounds for Invoking Writ Jurisdiction

- Violation of Natural Justice: For instance, the Authority failed to provide an adequate opportunity for the taxpayer to present their case. Consequently, this fundamental lapse justifies judicial intervention.

- Perversity of Findings: The AAAR’s conclusion is so unreasonable that no reasonable person acting on the facts could have reached it. Indeed, the finding must be completely irrational.

- Patent Lack of Jurisdiction: The Advance Ruling Authority fundamentally lacked the legal power to decide the specific question. Thus, this makes the entire ruling void ab initio or legally non-existent.

- Manifest Error of Law: The order suffers from an error of law apparent on the face of the record, requiring no deep factual inquiry. Therefore, the legal mistake must be immediately recognizable.

Strategies for Defending a Favourable Advance Ruling

Jurisdictional officers can also appeal an AAR ruling to the AAAR using Form GST ARA-03. Consequently, if the AAAR upholds the favourable AAR ruling, the Revenue Authority might still file a Writ Petition. Therefore, a robust defense strategy is absolutely essential for the applicant to maintain the tax certainty they initially sought. AskAdvocates Law Chamber excels in proactive defense, anticipating the Revenue’s arguments. We diligently prepare to counter any challenge at every level.

Key Defensive Measures and Keywords

The defense primarily focuses on establishing the correctness and legality of the ruling. Furthermore, we must prove that the Revenue’s appeal lacks legal merit or is based on factual misrepresentation.

Defending Against Revenue Challenges:

- Affirming Factual Accuracy: We demonstrate that the AAR/AAAR based its ruling on accurate, complete facts provided by the applicant. Consequently, this rebuts any claim of suppression of material facts.

- Upholding Legal Interpretation: We strongly support the ruling’s interpretation of the CGST Act or relevant notifications. Moreover, we rely heavily on comparable legal precedents and circulars.

- Demonstrating Binding Effect: We emphasize the binding nature of the ruling on the jurisdictional officer for the specific transaction. Therefore, the officer must adhere to the clear decision.

- Challenging Maintainability of Writ: We argue against the High Court entertaining the writ petition if the Revenue has not shown gross illegality. Importantly, the High Court’s jurisdiction is extraordinary and limited.

Rectification and Voiding Orders

The AAR or AAAR may rectify an order within six months if a mistake is apparent on the face of the record. Rectification of Orders helps resolve minor legal or clerical errors without recourse to an appeal. Conversely, a ruling can be declared void ab initio if obtained through fraud or misrepresentation of facts. This declaration can lead to significant retrospective liabilities for the taxpayer. Therefore, we provide meticulous pre-application legal consultancy to avoid any grounds for the ruling being voided. Furthermore, our robust documentation process minimizes risks associated with misstatement or omission.

AskAdvocates Law Chamber: Your 24×7 GST Legal Partner

We deliver seamless, 24×7 Legal Consultancy & Litigation Services across the entire spectrum of GST legal issues. Our experienced team provides expertise in GST classification disputes, Input Tax Credit (ITC) disputes, and complex Show Cause Notice (SCN) defense. We offer strategic guidance from the initial AAR application to the final Supreme Court appeal. Our commitment to clear communication and aggressive advocacy ensures your business is protected. Contact AskAdvocates Law Chamber today for an immediate, expert legal assessment of your Advance Ruling Order.

Frequently Asked Questions (FAQs)

A: The ARO is binding only on the applicant who sought the ruling and the specific jurisdictional GST officer concerning that applicant.

A: Yes. The concerned or jurisdictional officer can file an appeal against the AAR ruling to the Appellate Authority for Advance Ruling (AAAR).

A: The final remedy is to file a Writ Petition under Article 226 of the Constitution of India before the concerned High Court.

A: An appeal against the AAR order must be filed with the AAAR within a period of thirty days from the date of the AAR order.

A: A ruling can be declared void ab initio if it is found that the applicant obtained the ruling through fraud or suppression of material facts.

Read more

- How the Special Valuation Branch (SVB) Impacts Transfer Pricing and Import Valuation – Legal Helpline

- Analyze recurring tax conflicts, GST refund delays, and litigation pathways for disputed exemptions

- Resolving Tax Disputes Under STPI: Navigating Section 10A/10B Challenges

- Top 5 Compliance Mistakes in STPI Registration and How to Avoid Penalties

- When Can NCLT Refer a Case to Criminal Court?